47% of Russian families have a car. According to a poll by the All-Russia Public Opinion Research Center, for eight years this indicator grew by 10%. In 2006, only 37% of the respondents had a car in the family.

According to the Committee of Automobile Manufacturers Association of the European Business Association (AEB), in 2013 almost three million new cars were sold in Russia. In 2014, sales fell by 8%, but there is still demand.

Plans to purchase a four-wheeled “iron horse” are most often built by students (23%) and housewives (25%). Not surprisingly, every second new car in Russia is purchased on credit.

The popularity of car loans is explained by the fact that it is difficult to save and buy cars for cash. But there is another financial tool that makes the dream of a car sales. This is leasing.

Car leasing is a popular way of buying a car in the US and Europe. There up to 30% of cars bought by private individuals are in leasing. In Russia, this indicator is negligible. Why?

Let’s analyze the mechanisms of car loans and auto leasing, we will weigh their pros and cons and try to understand what is still more profitable.

Auto Loan

A car loan is an interest loan issued by a bank or other credit institution to an individual for the purchase of a car.

This is a popular form of consumer lending. Features:

- This is a targeted loan: you can only spend money on buying a car.

- This is a mortgage loan: the car remains in the mortgage with the bank before the loan is paid.

Legal regulation of car loans is carried out by the Civil Code (Chapter 42), the Law “On Banks and Banking Activities” (dated 02.12.1990), the Law “On Consumer Credit (Loan)” (dated December 21, 2013) and other regulatory enactments.

Types of car loans

To buy a car there are various loan programs:

- “Classic” (more details below);

- Express credit: a simplified procedure for processing, but high interest rates;

- Buyback loan: part of the loan is “frozen” and paid at the end of the contract period either by the borrower or by the auto dealer, provided that the proceeds are credited to purchase a new car;

- Trade-in: exchange of an old car for a new one with a surcharge. The cost of used cars goes to offset the cost of the new;

- Factoring (interest-free credit): 50% of the car’s cost is paid, the rest is paid in installments;

- Loan without down payment: when lending from an auto dealer, the absence of a down payment may be a bonus.

In addition, as an individual direction, you can talk about loans for used cars and loans without insurance.

Mechanism of car loans

Most often, they resort to classic car loans. Let’s consider its scheme.

You want to buy a car. There is no money for a new “iron friend”. You apply to a bank or a credit broker.

A credit broker is a commercial organization that is an intermediary between the borrower and the creditor (bank or car dealer). Helps in the approval and registration of a car loan.

Also, auto dealers can act as creditors. They provide loans from their own funds or cooperate with banks.

You choose a bank (or auto dealership), study credit conditions. After determining, fill out the questionnaire and collect the documents. The bank should make sure that you can pay out the loan (solvency), and you do not have other debts (credit history). Within a few days the bank thinks: to give out a loan or not.

If the decision is positive, the bank and the borrower (now it’s you) enter into a contract. It specifies the period, interest, first installment, rights, duties and responsibilities of the parties.

You buy a car. Sometimes banks recommend a specific car dealership, sometimes they build cooperation with the salon chosen by the client.

All the efforts for decorating the car lie on your shoulders. Also, most often the loan agreement provides for insurance at the expense of the borrower. And not only OSAGO, but also CASCO.

You are a happy motorist! The main thing is to carefully pay off the debt and do not forget that you though the owner, but the car is pledged to the bank. You not entitled to sell, donate or exchange it. And if there will be difficult times and there will be nothing to pay on the loan, the bank (auto dealer) will take your “swallow”.

Advantages and disadvantages of car loans

A car loan, as a financial instrument, has advantages and disadvantages.

Pros:

- You can have a car without capital. Buy a car for cash can unit, and save a long time and does not always work.

- Big choice. You can buy what you like, not what you have money for.

- A variety of lending programs: you can choose the most profitable for yourself (with a minimum period or, for example, without a long clearance).

Minuses:

- Complicated processing procedure. Strict requirements for the borrower.

- Increase in the cost of cars. You will have to pay interest + mandatory insurance.

- The pledge of the car.

Car leasing

The word leasing comes from English lease – “rent”. But in the Russian law leasing is not identical to leasing. We have this view lease relations. In them, one party (the lessor) invests money in the purchase of property, and the other (the lessee) accepts this financial service and uses the purchased property.

Leasing legal relations are regulated by the Civil Code (Chapter 34), as well as by the Federal Law “On Financial Lease (Lease)” of 29.10.1998.

The subject of leasing can be any non-consumable things (except land), including vehicles.

Mechanism of car-leasing

Car leasing is the acquisition and transfer of vehicles for temporary possession and use for a fee on the basis of an agreement between the lessor and the lessee.

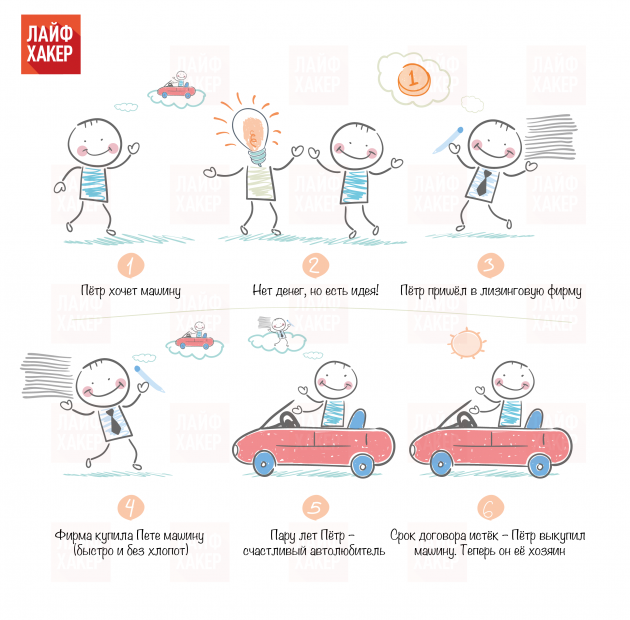

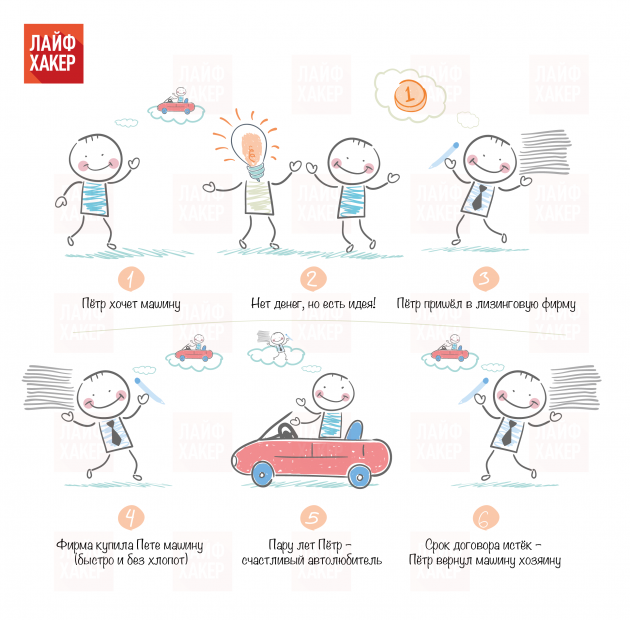

The general scheme is as follows.

You want a car. There is no money to buy. You are applying to a leasing company. You tell there what kind of car you would like to have, and show some papers.

Unlike the registration of a loan, the package of documents is minimal. As a rule, this application, passport and driver’s license. From a procedural point of view, leasing is much easier than lending.

Between you and the leasing company is a contract. From now on, you are the lessee.

Currently, the lessee can be both legal entities and individuals – NOT entrepreneurs.

Until 2010, the Law “On Leasing” contained a clause according to which the subject of leasing could be used only for commercial purposes. The buses, trucks and agricultural machinery were mainly used for leasing. There was practically no financial lease of cars.

But now there are leasing programs for citizens, for which they can get into use any car. Currently, only three companies are engaged in leasing for individuals in Russia.

After the conclusion of the agreement, the lessor buys “auto dreams” for you and transfers it to you for use.

Keyword – use. The owner of the car is the lessor. In this regard, it is he who deals with the registration of the car, the passage of technical inspections and other troubles.

It should be noted that all additional expenses incurred by the lessor (insurance, taxes, etc.) are ultimately paid by the lessee, since they are included in lease payments.

Leasing payments, as a rule, are less than payments on the loan. The fact is that they are calculated after deduction, the so-called residual value.

Residual value is a redemption payment for the car, which the lessee must pay at the end of the lease term in order to get the car into the property.

The amount of payments is also affected by the presence / absence of the advance and its size. In other words, the more you pay at the beginning and at the end, the less you will have to give monthly.

During the period of leasing (from one to five years) you are a happy motorist. The main thing is not to forget to make monthly lease payments and remember that at the end of the contract you will either have to buy out the car or return it.

Types of car leasing

There are two schemes of autolysis:

- Leasing with the transfer of ownership. When the leasing period is over, you can become a full owner of the car, having bought it from the lessor at a residual value.

- Leasing without the transfer of ownership. When the leasing period is over, you can return the car to the leasing company and choose another, having concluded a new contract.

Pros and cons of car leasing

Car leasing frees you from many troubles. For example, you do not need to waste time searching for a seller and decorating a car. And this is not the only advantage.

Pros:

- More flexible payment schedule. As a rule, they are lower than the contributions on the loan.

- Simplified procedure for collecting documents and signing a contract.

- The ability to update the car every few years.

Minuses:

- The car is owned by a leasing company. At the slightest problems with payments, as well as financial difficulties of the lessor himself, it can be withdrawn.

- The user of the car can not sublet him.

- Individuals do not have tax preferences for car leasing.

Car arithmetic

Knowing the mechanisms of car loans and auto leasing, the main thing is still the question: “What is more profitable?”.

To answer it, we asked the company Leasing-Trade to compare the costs of leasing for individuals and car loans under equal conditions. That’s what happened.

“It was chosen the property – a Toyota Corolla car of 2014, the cost of 690 000 rubles (sedan, engine power – 1.6, 122 hp).

Calculations of the car loan we took are typical: the loan amount is 690 000 rubles, the advance is 20% or 193 800 rubles, the term is 36 months. Based on the calculation of a car loan of a well-known bank (let’s call it X). The interest rate on its lending program with a standard set of documents is 15% per annum. The calculation was made without taking into account the programs of financial protection, MTPL, CASCO and additional expenses.

The calculation of leasing for individuals is based on the offer of one of the leasing companies (let’s call it Y). The monthly payment did not include MTPL, CASCO, as well as compulsory and related payments (transport tax, vehicle registration in the State Traffic Safety Inspectorate, annual maintenance, etc.).

The cost of maintaining the car will be approximately equal in both cases, are mandatory and calculated separately.

CASCO and OSAGO insurance was made on the basis of the following parameters:

- OSAGO: 5 500 rubles; region – Kazan; driver’s age is over 22 years; driving experience – more than 3 years; car power – 122 hp One driver is allowed to operate.

- Hull: 86,000 rubles; place of registration of the vehicle – Kazan; information on the individual: a man, 30 years old, marital status – married, one child; driver’s experience – more than 6 years, driving accident-free. One driver is allowed to operate.

| Auto Loan | Car leasing | |

| Car price | 690 000 rubles. | 690 000 rubles. |

| Interest rate | 15% | no, since the car is returning |

| Term (in months) | 36 | 36 |

| Initial payment of 20% | 138 000 rubles. | 138 000 rubles. |

| Payment type | uniform | uniform |

| Monthly payment | 19,135 rubles. | 11 790 rub. |

| Overpayment on interest | 135 000 rubles. | no, since the car is returning |

| Total amount of payments = amount of payments under the agreement (credit / leasing) + advance payment | 688,860 + 138,000 = 826,000 rubles. | 424,440 + 138,000 = 562,440 rubles. |

| Security deposit | 0 | 0 |

| CASCO insurance | 86 000 rubles. | 86 000 rubles. |

| OSAGO | 5 500 rub. | 5 500 rub. |

| Registration of a vehicle in the State Traffic Safety Inspectorate | 2 000 rub. | 2 000 rub. |

| Transport tax | 4 270 rub. | 4 270 rub. |

| Minimal revenue to buy | 31 900 rub. | 31 900 rub. |

| The market value of the car at the end of payments | 539 000 rubles. | 0 |

| Preliminary redemption payment | absent | 441 000 rubles. |

| Expenses for the purchase of a car in ownership | 826 000 rubles. | 562 440 + 441 000 = 1 033 440 rubles. |

“

Thus, if we consider the option in which leasing does not provide for the transfer of the car to the client’s property, the monthly payment under the leasing agreement will be lower by 7,345 rubles (38%). The costs of property insurance will be equal in both cases and are mandatory.

But if you take the situation in which the car is purchased for long (up to 5 years) operation, and in case of an individual leasing and subsequent redemption, then, of course, a car loan will be more economically expedient and cheaper way to get a car. Since the cost of acquiring (without taking into account insurance and compulsory expenses) will amount to 826,000 rubles at auto loan versus 1,033,440 rubles in auto leasing. “

At the same time, our expert draws attention to the fact that:

- on the popular and popular brands (Kia, Opel, Nissan, Mitsubishi, Chevrolet) and premium (BMW, Audi, Mercedes-Benz, Porsche and others), the discount of leasing companies can be on average 10%, which makes calculations much lower (often in two times) than by car loan.

- for premium customers with a high level of income, leasing will be profitable and comfortable service, since it is possible to include insurance, tax payment, car maintenance and repair in the payment.

What to choose?

After amending the Law “On Leasing”, many experts predicted a boom in leasing deals with individuals. After all, it would seem, the benefits are obvious. Do not need guarantors, fewer nerves in registration, and most importantly – leasing payments are not so burdensome for the family budget. But the boom did not happen.

Comparison table of auto leasing and car loans:

| Auto Loan | Leasing for individuals | |

| Property | New and Used Cars | Exclusively new cars of foreign production, except for Chinese cars |

| Term of financing | 12-60 months | 12-36 months |

| Prepaid expense | Banks rarely give out auto loans without a down payment. Minimum advance payment of 15% | Advance of 0%, but leads to a rise in the cost of monthly payments. Minimum advance payment from 20% to 49% |

| Package of documents | Standard: a passport, a certificate of income 2-NDFL, a copy of the work book. Reduced package is more expensive at rates | Standard: passport, driver’s license (sometimes also a certificate of income 2-NDFL) |

| Car insurance | Mandatory annual insurance of MTPL, CASCO. Optional: voluntary life and health insurance, financial protection programs. It is possible to include CASCO in payments | Compulsory motor third party liability insurance is mandatory. CASCO insurance is optional, but this leads to a rise in the cost of a monthly payment |

| Property rights | The car is the property of the client, but is pledged to the bank | The car is the property of the leasing company, and the client is transferred for temporary use under the agreement |

| Speed of registration | You can buy a car on credit in a short time with a minimum package of documents for the programs “Autoexpress.” As a rule, interest rates are increased by 2% | You can buy a car in a short time in leasing with a minimum package of documents |

| Restriction of run | Is not limited | Limitation of mileage up to 25 000 km per year |

| Other restrictions | – | Departure of the car abroad only on the official permission of the leasing company |

| Additional services and services | – | The lease agreement can include full insurance, annual technical inspections, seasonal tire service and tire storage, accounting features, payment of transportation tax and so on. All this leads to a rise in the cost of a monthly payment |

| Early partial or full redemption | Loyal banks are usually not limited in amount and timing | Strictly not earlier than 6 months |

| Redemption value | Absent | Corrected based on the condition of the car, can be calculated beforehand at the stage of the conclusion of the contract |

| Seizure of property | Through the court in the event of a delay in the contract | Under the contract, the owner of the property is a leasing company, in the event of non-fulfillment of obligations under the contract, the withdrawal is made without a court decision |

“

According to experts, the main reason for the lack of demand for leasing for individuals in Russia is in the tax system.

In the US, where auto-leasing is very popular, there is, so-called, “financial accountability of the household”. That is, the budget of a private person is treated in the same way as the enterprise budget. In this regard, taking a car in leasing, a citizen receives the same tax benefits as a businessman. In Russia, only legal entities can return VAT. For them, leasing is really beneficial, since it allows you to minimize taxes. For individuals, VAT is included in the monthly payments by the leasing company.

In addition, there is a significant difference in the psychology of domestic and Western motorists. “The car is not mine – it will take a little, and my money was crying.” Such arguments stop many who are eyeing auto leasing. Indeed, the leasing company, in order to claim a car in case of problems, you do not even need to go to court. Paying a loan, a person perceives it as a contribution to their property.

Thus, choosing between auto loan and auto leasing, it is important to understand your needs well. If you need a status car, and you want to regularly update the car, then, most likely, you will be suited to financial rent without a ransom. If you want a reliable “iron friend” for many years, then the loan will be more profitable.